Letter of credit

A letter of credit is a promise to pay.

Banks issue letters of credit as a way to ensure sellers (and sometimes even

buyers) that they will get paid as long as they do what they've agreed to do.

Letters of credit are common in

international trade, but they are also used in domestic transactions. Either

way, a bank acts as an uninterested party between buyer and seller and

guarantees that a payment will be made if certain conditions are met.

The

concept of a letter of credit can be complicated. The easiest way to get a

handle on things is to see an example with

visuals.

Importers and exporters regularly use

letters of credit to protect themselves. Working with an overseas buyer can be

risky because you don't necessarily know who you're working with. Your buyer

may be honest and have good intentions, but business troubles or political

unrest can delay your payment (or put your buyer out of business). In addition,

communication can be difficult across thousands of miles and different time

zones. A letter of credit spells out the details so that everybody's on the same page.

Elements of a Letter of Credit

- A payment undertaking given by a bank (issuing bank)

- On behalf of a buyer (applicant)

- To pay a seller (beneficiary) for a given amount of

money

- On presentation of specified documents representing the

supply of goods

- Within specified time limits

- Documents must conform to terms and conditions set out

in the letter of credit

- Documents to be presented at a specified place

The

Money Behind a Letter of Credit

A bank promises to pay on behalf of a

customer, but where does the money come from?

The bank will only issue a letter of

credit if the bank is confident that the buyer will pay. Some buyers have to

deposit enough money to cover the letter of credit, and some customers use a

line of credit with the bank (in other words, a loan is created when the

payment is made).

Sellers must trust that the bank issuing

the letter of credit is legitimate, and that the bank will pay as agreed. If

sellers have any doubts, they can use a "confirmed" letter of credit,

which means that another (presumably more trustworthy) bank will guarantee

payment. Sellers typically get letters of credit confirmed by banks in their

home country.

Executing

a Letter of Credit

A beneficiary only gets paid after

performing specific actions and meeting the requirements spelled out in a

letter of credit.

For

international trade -

The seller may have to deliver merchandise to a shipyard in order to satisfy

requirements for the letter of credit. Once the merchandise is delivered, the

seller receives documentation proving that he made delivery. The letter of

credit now must be paid – even (depending on how things are set up) if

something happens to the merchandise. If a crane falls on the merchandise or

the ship sinks, it's not necessarily the seller's problem.

To pay on a letter of credit, banks

simply review documents proving that a seller performed his required actions.

They do not worry about the quality of goods or other items that may be

important to the buyer and seller. That doesn't necessarily mean that sellers

can send a shipment of junk; sometimes an inspection certificate is required by

the letter of credit, so the buyer can be sure that the shipment is acceptable.

For

a domestic transaction-

A beneficiary might have to prove that

somebody failed to do something. For example, an organization might hire a

contractor to complete a building project. If the project is not completed on

time (and a standby letter of credit is used), the organization can show the

bank that the contractor did not meet his obligations. As a result, the bank

will pay the organization (so the organization can be compensated, or hire

somebody else to complete the project).

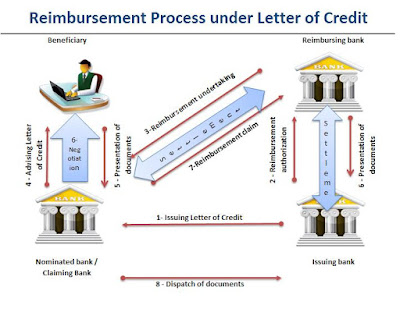

Procedures for Using the Tool

The following procedures

include a flow of events that follow the decision to use a Commercial Letter of

Credit. Procedures required to execute a Standby Letter of Credit are less

rigorous. The standby credit is a domestic transaction. It does not require a

correspondent bank (advising or confirming). The documentation requirements are

also less tedious.

- Buyer and seller agree to conduct business. The seller

wants a letter of credit to guarantee payment.

- Buyer applies to his bank for a letter of credit in

favor of the seller.

- Buyer's bank approves the credit risk of the buyer, issues and forwards the credit to its correspondent bank (advising or confirming). The correspondent bank is usually located in the same geographical location as the seller (beneficiary).

- Advising bank will authenticate the credit and forward the original credit to the seller (beneficiary).

- Seller (beneficiary) ships the goods, then verifies and develops the documentary requirements to support the letter of credit. Documentary requirements may vary greatly depending on the perceived risk involved in dealing with a particular company.

- Seller presents the required documents to the advising or confirming bank to be processed for payment.

- Advising or confirming bank examines the documents for compliance with the terms and conditions of the letter of credit.

- If the documents are correct, the advising or

confirming bank will claim the funds by:

- Debiting the account of the issuing bank.

- Waiting until the issuing bank remits, after receiving

the documents.

- Reimburse on another bank as required in the credit.

- Debiting the account of the issuing bank.

- Advising or confirming bank will forward the documents to the issuing bank.

- Issuing bank will examine the documents for compliance. If they are in order, the issuing bank will debit the buyer's account.

- Issuing bank then forwards the documents to the buyer.

Step-by-step process:

Standard Forms of Documentation

When making payment for product on behalf of its customer, the issuing bank must verify that all documents and drafts conform precisely to the terms and conditions of the letter of credit. Although the credit can require an array of documents, the most common documents that must accompany the draft include:

Commercial Invoice

The billing for the goods and services. It includes a description of merchandise, price, FOB origin, and name and address of buyer and seller. The buyer and seller information must correspond exactly to the description in the letter of credit. Unless the letter of credit specifically states otherwise, a generic description of the merchandise is usually acceptable in the other accompanying documents.

Bill of Lading

A document evidencing the receipt of goods for shipment and issued by a freight carrier engaged in the business of forwarding or transporting goods. The documents evidence control of goods. They also serve as a receipt for the merchandise shipped and as evidence of the carrier's obligation to transport the goods to their proper destination.

Warranty of Title

A warranty given by a seller to a buyer of goods that states that the title being conveyed is good and that the transfer is rightful. This is a method of certifying clear title to product transfer. It is generally issued to the purchaser and issuing bank expressing an agreement to indemnify and hold both parties harmless.

Letter of Indemnity

Specifically indemnifies the purchaser against a certain stated circumstance. Indemnification is generally used to guaranty that shipping documents will be provided in good order when available.

Common Defects in Documentation

About half of all drawings presented contain discrepancies. A discrepancy is an irregularity in the documents that causes them to be in non-compliance to the letter of credit. Requirements set forth in the letter of credit cannot be waived or altered by the issuing bank without the express consent of the customer. The beneficiary should prepare and examine all documents carefully before presentation to the paying bank to avoid any delay in receipt of payment. Commonly found discrepancies between the letter of credit and supporting documents include:

- Letter of Credit has expired prior to presentation of

draft.

- Bill of Lading evidences delivery prior to or after the

date range stated in the credit.

- Stale dated documents.

- Changes included in the invoice not authorized in the

credit.

- Inconsistent description of goods.

- Insurance document errors.

- Invoice amount not equal to draft amount.

- Ports of loading and destination not as specified in

the credit.

- Description of merchandise is not as stated in credit.

- A document required by the credit is not presented.

- Documents are inconsistent as to general information

such as volume, quality, etc.

- Names of documents not exact as described in the

credit. Beneficiary information must be exact.

- Invoice or statement is not signed as stipulated in the

letter of credit.

When a discrepancy is

detected by the negotiating bank, a correction to the document may be allowed

if it can be done quickly while remaining in the control of the bank. If time

is not a factor, the exporter should request that the negotiating bank return

the documents for corrections.

If there is not enough

time to make corrections, the exporter should request that the negotiating bank

send the documents to the issuing bank on an approval basis or notify the

issuing bank by wire, outline the discrepancies, and request authority to pay.

Payment cannot be made until all parties have agreed to jointly waive the

discrepancy.

Tips for Exporters

- Communicate with your customers in detail before they

apply for letters of credit.

- Consider whether a confirmed letter of credit is

needed.

- Ask for a copy of the application to be fax to you, so

you can check for terms or conditions that may cause you problems in

compliance.

- Upon first advice of the letter of credit, check that

all its terms and conditions can be complied with within the prescribed

time limits.

- Many presentations of documents run into problems with

time-limits. You must be aware of at least three time constraints - the

expiration date of the credit, the latest shipping date and the maximum

time allowed between dispatch and presentation.

- If the letter of credit calls for documents supplied by

third parties, make reasonable allowance for the time this may take to

complete.

- After dispatch of the goods, check all the documents

both against the terms of the credit and against each other for internal

consistency.

No comments:

Post a Comment